Americans with high -income Americans around the US are lagging behind on their credit cards and auto loans, a sign that even more than six figures that acquire more than six figures are more likely to struggle financially between changes in the economy.

All debt products for families earning more than $ 150,000 have been delayed by 2023 to more than double. This is less than $ 45,000, for families earning between $ 45,000 and $ 150,000, compared with an increase of 60% during that time, and for those who earn less than $ 45,000, for 22%, less than $ 45,000,

According to Vantagkor’s Chief Economist Ricard Settlement, high -income houses prepared later people better than low -grossing Americans, as they had a cushion to absorb inflation and other shocks.

But these Americans are now feeling the influence of many economic changes, including a weak job market and high housing costs for white-collar workers, they told CBS Manivach.

“For white-collar workers, it is probably even more difficult,” Bundbo said. “This trend has been consistent and it continues – it is not hating.”

About 38% of all new jobs made in five years paid up-to-average wages, Vantagkor’s data shows. But this year the stock has fallen to 7%, indicating that companies are building less white-collar posts. This is a challenge for high-ion Americans who face job loss because new employment can be difficult to detect compared to previous years.

“This group is being hit by many different aspects, making them difficult to end,” Bandbo said.

To ensure that the overall rate of debt luxury in the US remains higher than that of high-or-earn earners for medium-or-medium-or-I. For example, the crime rate for home earning houses at least $ 150,000 is now about 0.34% for low -income houses, vs. 1.75%. But the firm’s data shows that the increase in crime for high-or-I houses has increased rapidly than other groups.

A worrying sign?

An important question for the US is whether financial challenges facing high -income Americans can portray a comprehensive economic recession. In particular, the consumption of rich Americans now contributes now Half of all consumer expensesMain engine for economic development. Comparatively, in 1990, there was about one-third of all expenses of the economic ladder spent by Americans in 1990.

At the same time, according to the recently done in lower and medium-or-ore houses, about three-fourths of medium-income consumers are facing stifer financial headwinds with approximately three-fourths parts. survey Financial services company Primika.

The survey found that in about one-third of middle-income houses, or between $ 30,000 to $ 130,000, they say they have increased the use of their credit cards in the previous year.

Retail vendors and major consumer brands have also warned that some consumers are cutting back or are more cautious in their purchase.

Shopkeepers “are looking for value, either in small packs and promotion or large pack sizes in club channels and online,” Proctor & Gamble Chief Financial Officer Andre Shults said an earning conference call on Tuesday. “This is the behavior we have mentioned earlier, but it is not closed. It continued.”

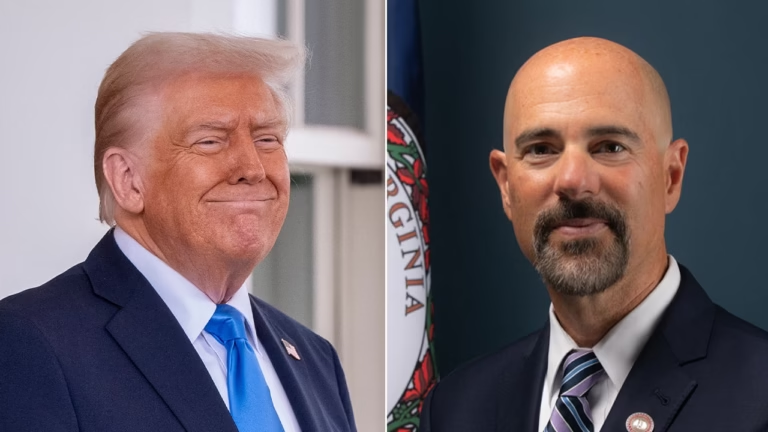

Comprehensive consumer frustration with high prices is believed to have encouraged President Trump during the 2024 election campaign, when Mr. Trump when Mr. Trump Vow to finish “Inflation nightmare.” So far, inflation remains relatively silent in 2025, although the 2.7% annual rate of June remains higher than the target of reaching 2% rate of Federal Reserve.

Nevertheless, more consumers are now expressing disappointment with the economic policies of the Trump administration, according to a new CBS News Poll which has been found almost. 64% of Americans now rejected How the President is handling inflation. The survey was held from 16–18 July and 2,343 adults were voted.

For those Americans who are struggling to live with credit-card loans and auto loans, they are never likely to see relief soon. Although Mr. Trump Federal Reserve President Jerome Powell is emphasizing low interest rates, economists feel that the central bank is Pat is very likely to stand up When officials announced their latest policy step on Wednesday.