federal Reserve Said On Wednesday, its benchmark interest rate has been kept unchanged, citing high uncertainty on the country’s economic approach.

The decision to keep the rates stable marks the continuation of the strategy of the Fed’s “waiting-and-look” this year, as it monitors the impact of the Trump administration tariff on consumer prices. But Wednesday’s policy statement also underlined that development remains solid despite concerns about slowing down economic activity.

The Central Bank’s rate-setting panel said, “Although the swings in net exports continue to affect data, recent indicators suggest that the growth of economic activity has been moderated in the first half of the year.” “The unemployment rate remains low, and the labor market situation remains solid. Inflation remains somewhat high.”

Two polling FOMC members, Governor Michelle Boman and Christopher Waller voted in favor of reducing the short-term rate of the Central Bank, a rare show of dissatisfaction in the-Fed, where monetary policy is generally determined by consensus. This is the first time since 1993 that two members of the Fede Board of Governors of Fed have voted against the chair, according to Capital Economics.

In number

The Central Bank said on Wednesday that it would increase the rate of Federal Fund from 4.25% to 4.5%.

The last time the Central Bank cuts were in interest rates in December 2024, when it sorted the rates by 0.25 per cent marks.

According to the financial data firm FactSet, Wall Street feared Fed’s decision, the economists promoted the possibility.

Why is fed holding rates stable?

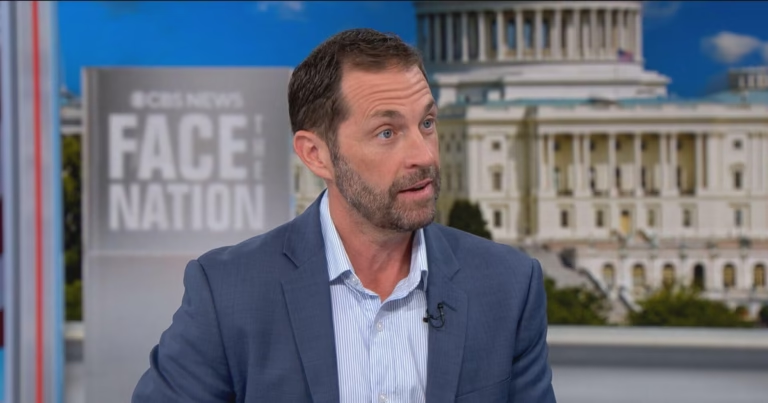

Federal Reserve Chair Jerome Powell has indicated Fed Be cautious Regarding the onset of low rates, given the possible impact of the tariff of the Trump administration, which he has said that he believes that inflation may cause inflation.

American inflation still remains above the target of the Fed, taking it down to 2% annual rate, with the consumer price index Inching To reach 2.7% on an annual basis in June. At the same time, the economy remains concrete, with today’s GDP report looks stronger than expected. An increase in the second quarter of 3%Economists say that economists say, providing more ammunition to support the fed’s argument to keep the rates stable.

“it [GDP] The report of transferring the stance of the Federal Reserve is unlikely, “Bolwin Wealth Management Group President Jina Bolwin said in an email before the Fed’s decision. The central bank will wait for more consistent signals before considering the” rate cut. ,

According to the factset, economists have currently predicted the possibility of 63%. The Federal Open Market Committee, the Central Bank’s rate-setting panel is not available in August, which has the next chance to cut the September meeting rate.