Federal Reserve Chairman Jerome Powell indicated that a rate may be cut, which grew on Friday after a signal to cut a rate during a speech at the policy seminar in Jackson Hole, Vyoming.

Dow Jones Industrial Average climbed 936 points, or 2.1%by 11:56 am on Friday, while S&P 500 scored 102 points or 1.6%. Tech-Havi Nasdac Composite was up 1.9%.

In an ah-uttering signal of relief for investors, Fed Chair Powell said in his speech on Friday that the current risk situation “may be warrant to adjust our policy stance.” The central bank will continue “proceeding carefully”.

“Our policy rate now has 100 basis points, which is close to neutral than a year ago, and the stability of unemployment rate and other labor market measures allows us to move carefully because we consider a change in our policy stance,” Powell said.

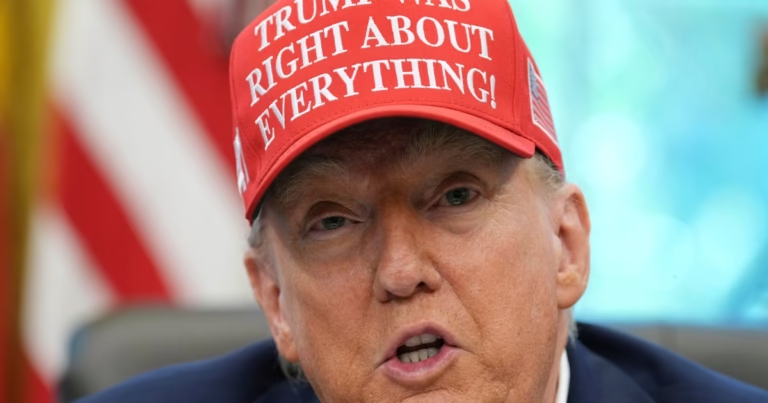

Despite increasing pressure from President Trump, Fed has cut rates this year as it monitors the inflation of the Trump administration and the impact of tariffs on the labor market. Pavel’s speech on Friday, however, the strongest indication may be that policy changes can be overcome.

“Powell admitted that the Fed may have time to change its restrictive policy, it could install stock for a short -term relief rally,” Brett Kenwell, Atoro Investment Analyst said in an email note on Friday.

Oxford Economics chief American economist Ryan Sweet, Ryan Sweet, Ryan Sweet, Ryan Sweet, “When Fed Chaws open the door for a rate cut.” “August Employment Report or Consumer Price Index is not enough to change Powell’s opinion.”

The Central Bank has been tasked with the so-called double mandate of maximum employment and minimum inflation-a difficult balance to reduce onion rates that can promote job increase to reduce interest rates, while inflation can be more ticking, and vice versa.

On Friday, Powell said that the job force growth has been “very slow” and “negative risks for employment are increasing.” In July, the job became weaker than the increase in the job, with employers added 73,000 jobs. Labor department also amended the growth of jobs Fast down For May and June.

“Overall, while the labor market seems to be in balance, it is a curious type of balance, resulting in a marked slow in both the supply and demand of the workers,” he said.

This year remains in inflation investigations, although it is still above the 2% target of the Fed. Powell said on Friday that Tariff has started increasing prices in some categories.

The Federal Open Market Committee (FOMC), Central Bank’s 12-person interest rate-setting panel, is scheduled to meet the next on 17 September. Interest rate traders are now expected to cut 89%, According For fedwatch tool of CME Group.

In the stock markets abroad, after government data, Germany’s DAX returned to 0.4%, which revealed that its economy was reduced by 0.3% in the second quarter as compared to a period of three months.

With shares climbing 1.4% in Shanghai and 0.9% in South Korea, the index increased in most parts of Asia.

Contributed to this report.